“The biggest question in CPG right now is how do I stay in stock,” said one Omni-Channel leader from a national manufacturer.

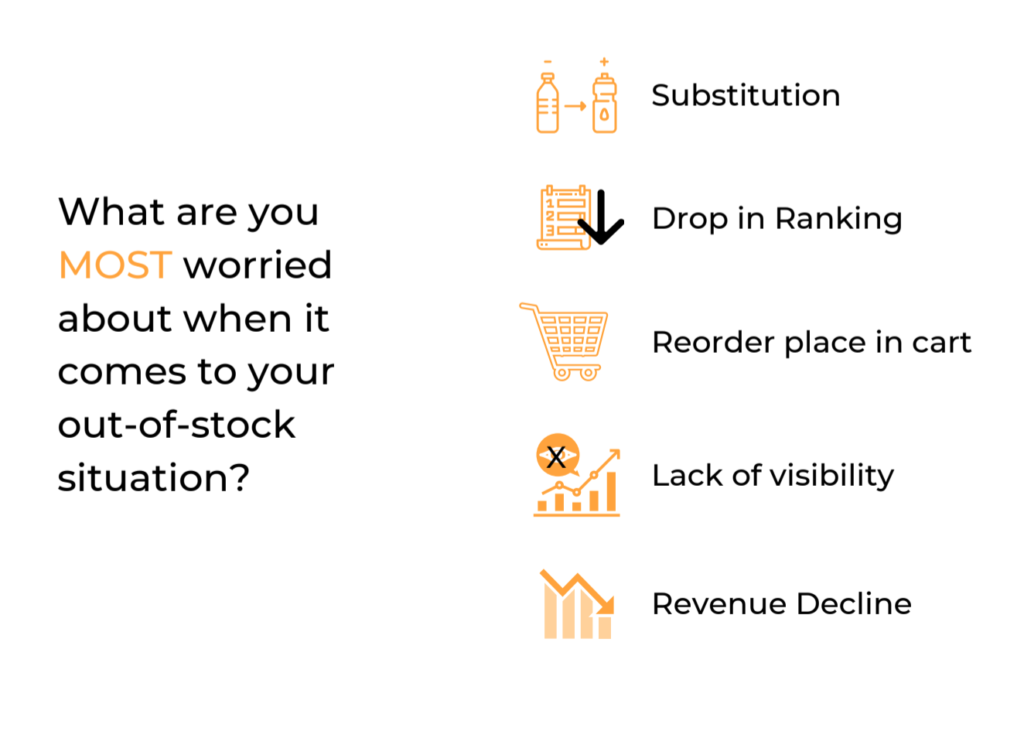

This realization isn’t an isolated problem as more brand leaders tell us that it is more than just being out of stock that keeps them up at night. It is the lack of visibility to the when, where, why, and impact of out-of-stocks across retailers that is paralyzing brands from even addressing the issue.

What if we stopped thinking about out-of-stocks as a tactical problem where we need to stop the bleeding as soon as possible?

What if we stopped thinking about out-of-stocks as a tactical problem where we need to stop the bleeding as soon as possible?

Instead, what if we apply a Revenue Growth Management lens to the out-of-stocks and build a strategy that brings together pricing, promotion, availability and assortment to start thinking about revenue generation and profitability.

The reasons that this isn’t happening more are that brands:

- Lack of timely data

- Have quality issues with their data

- Are using their data reactively only to explain what when wrong

When this happens, brands tend to respond to drops in sales volume by pushing promotional and marketing investment to drive incremental volume, regain lost search ranking, and mend relationships with retail partners.

Incrementally, this work. Until the next out-of-stock.

These back and forth reactionary practices just aren’t sustainable.

The Importance of Accurate & Actionable, Data

Before brands get to changing their mindset, they must change the “ingredients” they are using to make decisions. For brands to truly understand the magnitude and impact of their out-of-stock landscape they need:

- Daily zip-code level pricing and availability data across multiple retailers

- Competitive pricing and availability data

- Keyword search ranking data

It is important to note that this data is only as valuable as it is accurate.

2 Ways to Think More Strategically About Out-of-Stocks

1. From reacting to reducing to preventing

When we stop thinking tactically about out-of-stocks our brands can see past an out-of-stock as just contributor to poor sales and start thinking about an out-of-stock as an outcome of missed opportunity.

In other words, if the out-of-stock is the outcome of too large of promotion, missed projections from demand planning, a supply chain disruption or competitive circumstance, then the action brands need to take is to correct/address the factor that can cause the out of stock from repeating.

When brands make this change, we see conversations shift from “how do we regain our search position” to:

- What SKUs, in what places, allow us to maximize revenue without going out of stock?

- What promotions drive incremental volume or sales with product available throughout the duration of the promotion?

- What retailers and, when applicable, what specific stores represent my biggest out-of-stock revenue risk?

As we use our data to explore the answers to these questions, we begin to make decisions that prevent out of stocks and have longer term impact – such as solidifying our search position longer than just our next out of stock.

2. Compete and Collaborate Better

As potentially damaging as out-of-stocks are in terms of sales and brand loyalty, there is also significant strategic opportunity that sits with having the right knowledge.

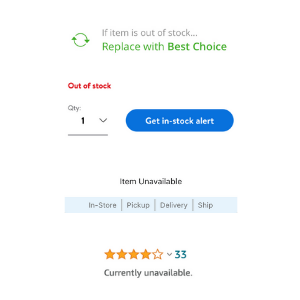

This starts with a thorough understanding of the relationship between your out-of-stocks and your competitors’ out-of-stocks. All brands fear being substituted, but for example, what do you need to do to be the substitute of choice when your competitor is out of stock?

Looking at competitive data, you can not only see when your competitor is out of stock, but also how you or other brands are positioned during the competitor out-of-stock to fill the space.

Similarly, out-of-stocks hurt retailers because at times an out-of-stock means a shopper is looking someplace else for your product. If you can demonstrate that you are open to reducing out-of-stocks in collaboration with your retail partners, the collaborative possibilities are endless.

This means using your data to find opportunities that are mutually beneficial.

Out of Sight = Out of Mind

Being out-of-stock does mean that your shopper can’t buy your product and a lost sale. However, the failure to elevate and bring visibility to potential losses and strategic opportunities surrounding out-of-stocks also results in lost sales of a potentially greater magnitude.

For brands to finally answer the “how do I stay in stock” question, they also must invest in the data to answer more complex questions that provide strategic direction at the product and store level to create lasting, revenue-impacting change.