While the growth of 2020 and the optimistic outlook for 2021 has brands and retailers hungry for the opportunity, questions about the profitability of e-commerce and omni-channel sales is leaving many searching for ways to control their bottom line.

According to the McKinsey study, “High growth, low profit: The e-commerce dilemma for CPG companies,” “When we polled US CPG executives during a June 2020 webinar, more than one in four respondents said that low profitability was their number-one concern with regard to e-commerce. Yet e-commerce will almost certainly be one of the primary sources of growth for CPG companies in the foreseeable future.”

Where Should Brands Start?

“For brands that have not already adopted an e-commerce or digital marketing strategy, doing so will become a top priority to keep pace.” states Food Dive writer, Lauren Manning, in the article, “COVID-19 has fundamentally changed the CPG industry, report says.”

The one critical component for brands looking to build an effective omni-channel strategy is data.

The one critical component for brands looking to build an effective omni-channel strategy is data.

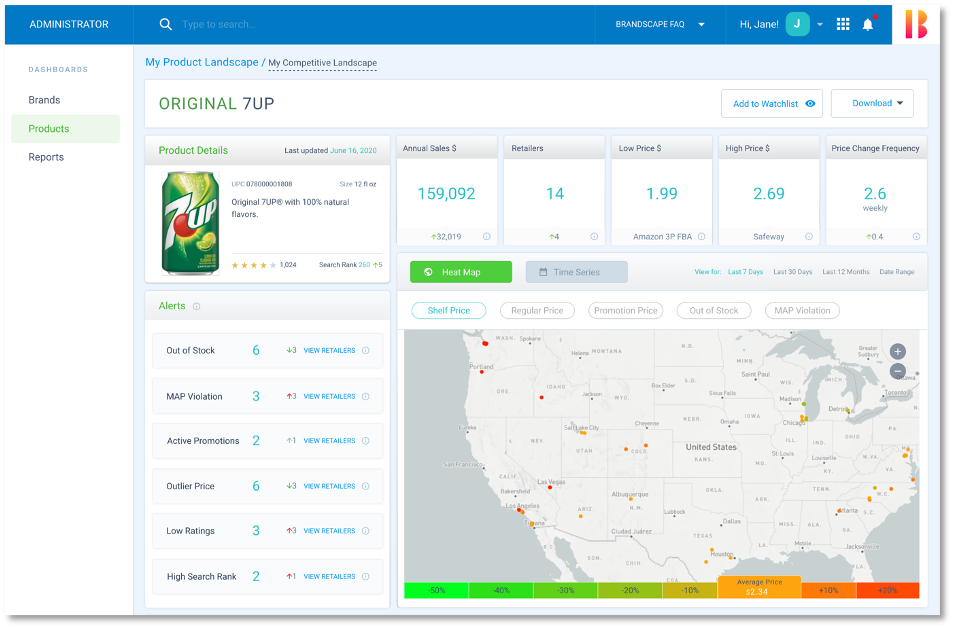

The truth is that changes to pricing, promotion, assortment and availability simply move faster in a digital world. It is the inability to have visibility to key metrics like IMAP compliance, out-of-stocks, search ranking, promotional execution, and competitive activity that are making strategic decisions about which levers to pull and which investments to make difficult.

Not only is visibility an issue, but the inability to act in these areas is causing the bottom lines of brands to leak unnecessarily.

We continue to see brands lose sales, incur retailer penalties, and struggle with over/under stocks because they don’t have a timely and accurate picture of their digital shelf.

According to the same McKinsey study, there are 3 areas where manufacturers can protect their

profitability:

- Marketing & Promotions

- Revenue Growth Management and Pricing

- Supply Chain Management

To manage these strategically and effectively means having the visibility to understand and affect the relationship between these areas.

For example:

- Can you forecast volume for anticipated pricing compliance issues?

- How often are your products out of stock when on promotion?

- How does search ranking changes impact sales volume?

- What pricing promotions help you regain your search position?

- To what extent are competitive promotions impacting your position and sales?

These are just some of the questions that you will want to assess, but these types of questions signal a change in the way that you talk about Ecommerce and omni-channel strategy when you have the right insights.

“We Are Not There Yet” Isn’t Working Anymore

There was a time where it was easy to brush off e-commerce as “just a small part of our

business.” This is no longer true.

As a result, brands must take steps to control the areas where they have the most influence – pricing,

promotion, assortment, and availability.

This starts with simply seeing what is happening with your products, retailers and competitive brands.

The next step in your maturity is to use your historical data to identify opportunities and improve forecasting. The more breadth you have into your retailer ecosystem, the more likely you are to find opportunities to tighten bottom-line erosion and improve profitability. While doing so at large retailers like Amazon and Walmart is key, identifying and improving outcomes with those retailers competing with Amazon and Walmart is a recipe for mutually beneficial

outcomes.

With worries about profit margin compression influenced by the unknowns of managing Ecommerce and omni-channel selling, brand executives are looking for evidence that your company has a data-driven strategy to not only take advantage of the increased demand, but do so in a way that aligns with your company’s growth objectives.

This means that the companies with the ability to have accurate insights, can build a story that their executives believe in and can execute on this strategy effectively are best positioned to win today and grow in the future.